These days, people are more mobile than ever, living, working, and owning assets in countries around the globe. It makes sense to plan ahead.

For instance, are you certain:

- what happens to your online financial accounts like banking, insurance, investments, cybercurrency, or rewards points?

- what happens to your social media accounts like Facebook or Twitter, or image libraries in the cloud?

- that you have provided the means for your heirs/successors/family to access your digital assets?

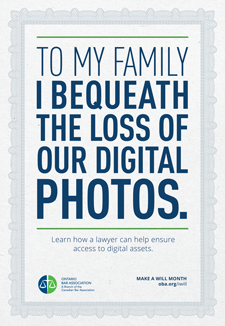

A lawyer can help ensure access to digital assets.

With technology being such a constant and significant factor in our lives, it makes sense that our digital assets need to be considered when planning for the future.

You may not have considered the value of your digital assets, and what losing them might mean to your loved ones. A lawyer can work with you, through your will and perhaps through an estate plan, to:

- identify your digital assets, and work with you to identify the assets that can (or can’t) be transferred to your loved ones;

- protect the wealth you may have accumulated online such as rewards points, cryptocurrencies, or funds raised on crowdfunding sites; and,

- protect against identity theft, privacy breaches and commercial losses that could negatively impact your family, your assets and your personal legacy.